When it comes to property investment, savvy investors are increasingly turning to limited companies.

The advantages go well beyond tax efficiency. Property investors can unlock greater returns, simplified estate planning, and seamless group investments. Here’s a look at just some of the unparalleled potential that awaits your next property investment when using a buy-to-let limited company.

1. Tax efficiency: maximise your buy-to-let returns

Investing through a limited company can be more tax-efficient compared to investing in your personal name. Limited companies are subject to Corporation Tax of 19% on profits up to £50,000, while personal investments can face Income Tax rates of up to 45%.

Limited companies also allow 100% deduction of mortgage interest payments from rental income, resulting in reduced taxable profits and lower tax liability. When it comes to extracting profits, limited companies offer tax-efficient methods such as dividends, owner/director loan repayments, and pension contributions. Learn more with our tax efficiency guide.

2. Streamlined estate planning: protect your assets

Investing through a limited company simplifies estate planning.

By transferring assets through a limited company, you can minimise the tax liabilities you pass on to loved ones. For instance, gifting 99% of company shares while retaining directorship allows beneficiaries to pay Inheritance Tax on just 1% of the shares.

Offering unparalleled flexibility in estate planning, limited companies enable the gradual share transfers or immediate transfer of a 99% stake upon incorporation. Even after gifting 99% of shares to a beneficiary, maintaining directorship ensures control and security over the investment until the ideal time for transfer.

3. Seamless group investments: buy with friends

Limited companies offer particular advantages for group investments. Investing as a group through a limited company ensures clear ownership by distributing shares based on individual contributions, guaranteeing fair allocation of rental income. Moreover, limited companies provide shareholders with legal protection through a Shareholder Agreement, specifying investments and profit-sharing, ensuring a secure and harmonious investment environment.

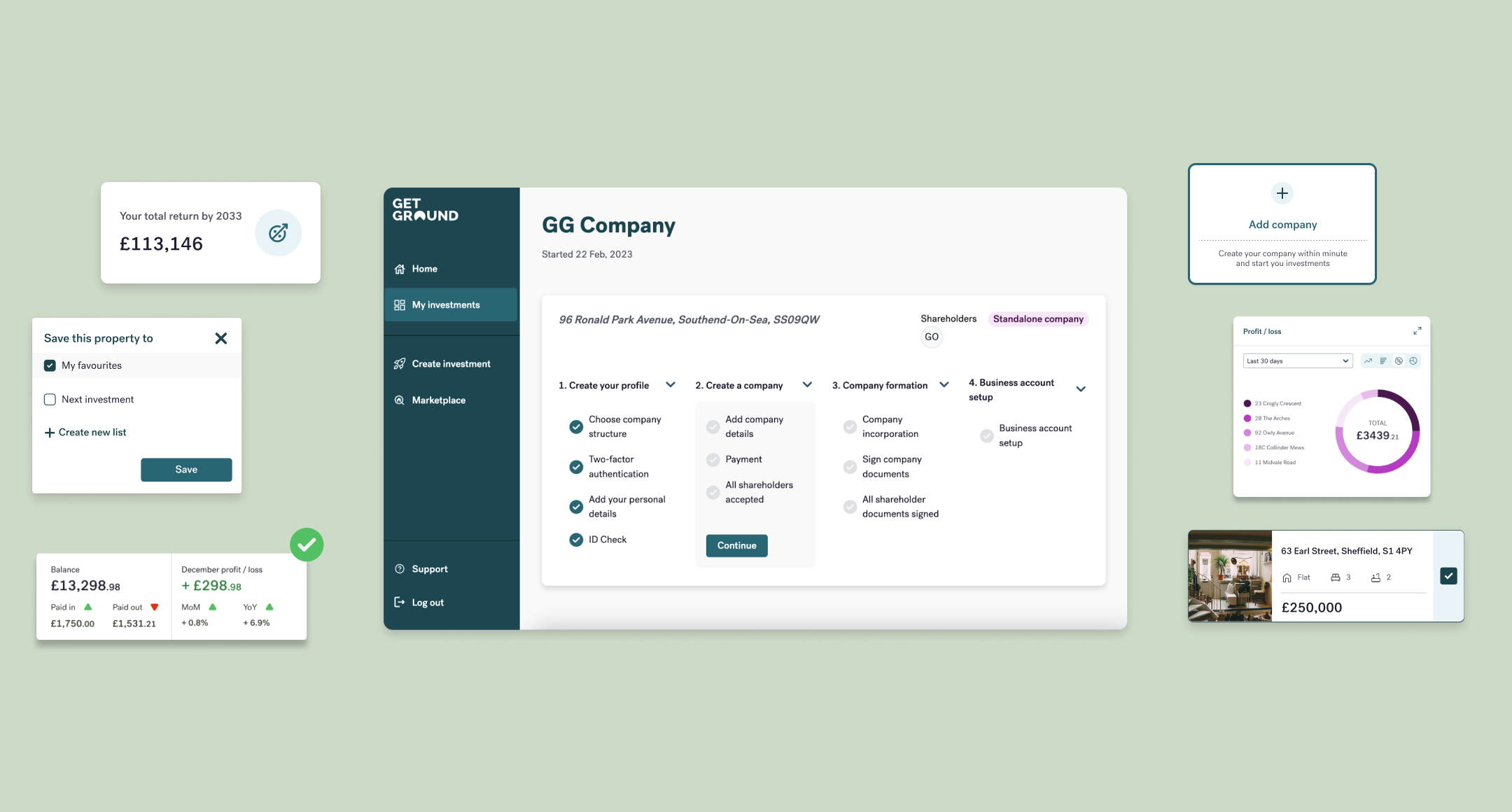

Setting up your buy-to-let limited company

The benefits may be easy to understand, but when it comes to setting one up, limited companies can be expensive and cause you more hassle and hard work when you’d rather focus on the property purchase itself.

How can GetGround help?

Here’s everything that’s included when you create a limited company with us.

1. Business accountA business account with a UK account number and sort code. Based out of the UK? We’ll provide you with an international account with IBAN and BIC for international transfers alongside currency conversion services as required.

2. Annual Accounts

Preparation and filing of end-of-year company accounts every accounting year with a dedicated support team. Need answers to more questions? We also host multiple webinars throughout the year with the accounting team to assist with common questions about company accounts and to run through the GetGround process.

3. Tax filings

Preparation and filing of annual company tax returns every accounting year, along with preparation and filing of Annual Tax on Enveloped Dwellings (ATED) return (if required).

4. Dividend administration

Provision of all dividend documentation, including board minutes and dividend vouchers, to enable dividends to be drawn.

5. Property change requests

Support with changes to property details pre-completion – this enables you to easily update your owners loan and the required board minutes should the property you are purchasing change.

6. Registered and correspondence office address

Acting as the registered address and correspondence address with our main London location for the company and the directors.

7. Post management

Receiving, scanning and uploading all company post to your GetGround account for easy access no matter where you are – you won’t miss out on any important messages.

8. Share transfers (prior to property completion)

GetGround facilitate one change to the company shareholding structure prior to the purchase of the property, this includes:

- Provision of standard share transfer documentation, including stock transfer forms, share purchase agreements and updated shareholders agreement

- Onboarding of any new shareholders

- Appointment and resignation of directors as a result of the shareholder changes (if required)

- Filing changes at Companies House

9. Maintenance of statutory registers

Each company you make with GetGround is ‘proofed’ at companies house to protect your company from unauthorised or fraudulent changes to your records

And that’s not all. We’ll also look after the maintenance of statutory registers for you, including annual confirmation statement filing and Companies House filings, which ranges from changes to company details to changes in director(s), shareholder(s) and persons with significant control.

10. Customer support line

Dedicated customer support line for queries in respect of your company – you can reach us through WhatsApp and phone number, by requesting a callback, or by booking in a one to one meeting to get personalised support through your journey.

What other services can GetGround provide?

From time to time, you may require further assistance from us. We can offer bespoke, additional support to you above your standard subscription fees with us in the following areas:

- Acting as your process agent, for international shareholders

- Additional share transfers, once your company is set up

- Owner loan amendments

- Intercompany loan documents

- Letters to third parties

- Additional accounting services, such as amended or expedited accounts

- Personalised, one hour support call with our team

If you do not see the service that you need listed here please contact gethelp@getgroud.co.uk and let us know – we are always happy to discuss requirements and try to assist if possible

Are you ready to get started?

If you want to discuss your property investment needs, no matter what they may be, book in a call here at your convenience for a personalised chat with a property consultant.

Structuring your property investment

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

Cecilia Foderaro

Cecilia Foderaro is a Buy-to-let Specialist at GetGround. Book in a call with her here for a personal consultation.

Discover our recent property investing articles:

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...

How Economic Factors Can Impact UK Landlords

Even with the recent volatility of the UK economic market, the UK property market has remained resilient with homeowners and property investors still ...