Whether you’re a first-time buyer or a seasoned investor, the chances are your property search starts online.

How to begin your property investment search

Most likely, it’ll be a property listing website – like Rightmove, or Zoopla. But, if you’re looking for a buy-to-let investment, are these platforms the best places to look?

These two sites dominate the landscape of property for sale. And with good reason – they’re simple, user-friendly, and offer the average buyer a broad choice across the UK. But there are some things Zoopla and Rightmove can’t do – especially if you’re an investor. If you only search on these platforms, you risk missing out on exciting opportunities elsewhere.

We’ve taken a look at both Zoopla and Rightmove, to establish what they’re good for, and perhaps where they fall short. All to help you start your property search on the right foot.

Why start with Rightmove or Zoopla?

If you’re looking for your first (or next) home, no property portal beats Rightmove and Zoopla. While there are some differences in terms of what the two offer, they’re mostly similar, and both are great places to start your property search. Here’s why:

1. Sheer volume of properties

Rightmove lists about 800,000 properties for sale or to rent at any one time, and Zoopla comes in at about 700,000. This means prospective buyers can scroll to their hearts’ content, but they can also quickly search and filter to (hopefully) find their perfect residential property.

2. Variety of stock

Because of their enormous reach (over 100M combined website visits in January 2023 alone), these portals pull in thousands of listings from small, local property agents up and down the UK. This guarantees a rich variety in the types of home you can browse on Zoopla and Rightmove – from floating homes to retirement homes, and everything in between.

3. Valuable insights for residential property buyers

Both portals offer useful insight into the properties for sale that they list (although the exact info varies between platforms).

On Rightmove, you’ll find basic data associated with each property, like a mortgage calculator, area information (e.g. transport links, schools) etc.

Zoopla takes it a step further, offering handy tools like SmartMaps, which lets you mark the area where you’d like to run your property search, rather than just relying on broad information like whole towns or postcodes. You can even find properties that fall within a certain commute time from your workplace.

The limitations of Zoopla & Rightmove

We’ve established that both Rightmove and Zoopla are ideal starting points for your typical residential property search. But what about if you’re not looking for a home? What if you’re hunting for an asset – a profitable investment opportunity? This is where we start to see the limitations of portals like Rightmove and Zoopla.

Finding your perfect buy-to-let investment property is totally different from finding a forever home. So it demands a different toolkit. Here are three things to consider the next time you turn to Zoopla or Rightmove in the search for your next investment:

1. Leave no stone unturned

The best investments rarely lie on your doorstep. For high yields and existing capital growth prospects, you’ll often need to look further.

The issue here is that Zoopla and Rightmove don’t actually have a large selection of UK buy-to-let investment opportunities. Because most developers don’t tend to list their new build stock on these portals, you’d need to call hundreds of them to get a proper nationwide picture of the available stock. This is obviously a lot of hassle – leaving many investors to look for investment opportunities in regions close to them. But this makes it easy to miss exciting opportunities further afield.

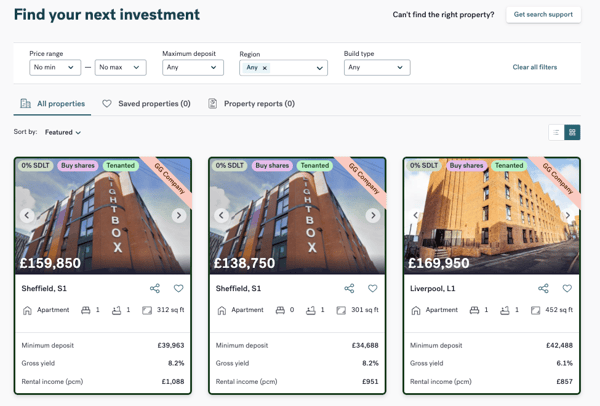

At GetGround, we’ve solved this problem – by putting thousands of exciting buy-to-let investment opportunities under one roof. Now you can browse properties from all over the UK, without relying on the narrow selection on Rightmove or Zoopla.

2. Data, data, and more data

Whether you’re looking for high rental yields in the short term, capital growth for the future, or perhaps a bit of both, investing confidently takes data. From projected rental returns to likely yields and capital growth, it pays to understand how your investment will shape up before you spend any of your hard-earned cash. After all, the last thing you want is a second-best investment.

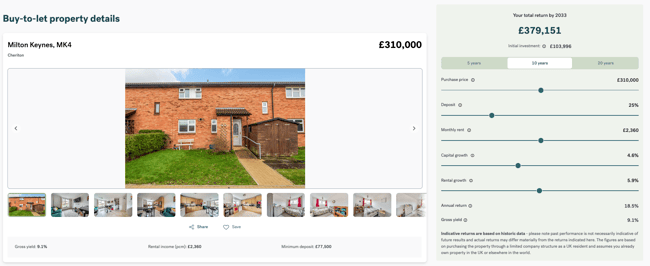

The bad news is, you’re unlikely to find all this tasty data in Zoopla or Rightmove. The good news? You can find it all in GetGround’s Property Investment Platform. Each of our property listings comes with a detailed returns calculator, which lets you see projected costs and returns for each property, and toggle for short-, medium-, and long-term investment timelines. You can also create unique property reports, comparing all the data for investment opportunities that catch your eye. This way, you can find your perfect property investment in no time at all.

You can also find out valuable insights by using the Buy-to-Let Earnings Calculator to compare what you'd earn if you invested through a limited company, and in your own name. You could also use the buy-to-let mortgage calculator, find out in a few seconds how much could you borrow to purchase a property in your own name VS through a limited company. Or take it a step further by finding out how much Stamp Duty you'll pay on a freehold residential property purchase with our handy calculator, whether you’re buying in England, Scotland or Wales.

3. Easy to let, easy to maintain

It sounds obvious, but buying to let brings with it a whole host of new considerations that you wouldn’t worry about if you were just buying a home. For instance, is tenant demand sufficient to avoid void periods? To address this, you might consider a House in Multiple Occupation, or HMO, or investing in a two-bedroom flat rather than a one-bed. Also, maintenance. Will you choose a more modern property that’s easier to maintain? Or will you go with a pre-owned property – with the higher upkeep costs they tend to bring with them?

These are crucial considerations to bear in mind as early as possible in your investment journey. And while BTL property experts will be able to advise you on the best property for your specific goals and budget, you’re unlikely to get all this information from your average property agent. With GG Search, you can get a dedicated property agent to support you every step of the way. Click here to get in touch with one of them! You could also check out this video series that uncovers all the details of buy-to-let property investing in the UK.

In summary: frequently asked questions

Which one is best between Rightmove VS Zoopla?

The key differences between Rightmove VS Zoopla are the amount of properties they display (around 800,000 for Rightmove against a little over 650,000 for Zoopla), as well as the functionalities that they offer. While they both include information on house prices, Zoopla’s property searching capabilities are more refined and varied. It’s also more suited to selling a property, as opposed to Rightmove which is focused on finding residential property for sale.

Which is the best UK property website?

Rightmove and Zoopla are clear leaders of the UK property website industry. However, if you want to take your property search even further you can also browse on Prime Location, OnTheMarket, Placebuzz or Gumtree.

Is Zoopla part of Rightmove?

Rightmove and Zoopla are separate companies who offer similar services and are in direct competition. Also, while Zoopla has been acquiring other websites since its inception (such as uSwitch, Prime Location and SmartNewHomes), Rightmove has not diversified its revenue streams.

Why do some estate agents not use Zoopla?

Due to the amount of reach that Rightmove and Zoopla have, their prices are quite competitive which is why some property agents prefer to go for cheaper alternatives such as OnTheMarket.

What is the best property portal for your buy-to-let investments?

Without a doubt, first-time buyers looking to buy a home should head straight for Rightmove and Zoopla. But, if you’re looking for a profitable investment, these portals have fundamental shortcomings that are tough to see past. Not only is there limited choice and little data, but there’s also very little tailored support for investors. Luckily there’s a handy alternative: GG Search.

With GG Search, you’ll find:

- Thousands of vetted buy-to-let properties from all over the UK

- Extensive data & insights, making it easy to review and compare for each property

- Experienced property consultants to guide you from search to exchange

Looking for your first (or next) buy-to-let property investment? We’d love to hear from you, book in a call to find out more or go straight to browsing properties on our marketplace.

Finding your buy-to-let property

GetGround's property marketplace hosts a range of vetted new-build and second-hand properties that investors can use to start or build their portfolios. GG Search helps you make an informed decision about your next property investment by equipping you with interactive costs and returns reports. Ready to find your next buy-to-let investment?

GetGround

GetGround

Discover our recent property investing articles:

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...

How Economic Factors Can Impact UK Landlords

Even with the recent volatility of the UK economic market, the UK property market has remained resilient with homeowners and property investors still ...