When it comes to property investing, the way you structure your investment impacts the way you pay tax on it. If you hold your property in a limited company, the company is a legal entity on its own and is separate from the shareholders and directors of the company. This means the limited company is the structure being taxed rather than the company’s owners.

The complexities of buy to let tax liability are a large reason many investors opt for using a landlord accounting software or get a dedicated buy to let accountant. These services support you with your investment profitability, and although these are both great options, it's still important to know what tax your buy to let limited company might be subject to.

So, when does a limited company created for property investing need to pay tax? It is typically at three main points: when you initially purchase the property, when you make profits from the investment, and when you sell the property. Let’s break down each of these stages and the tax that comes with them.

Purchasing the property: Stamp Duty Land Tax

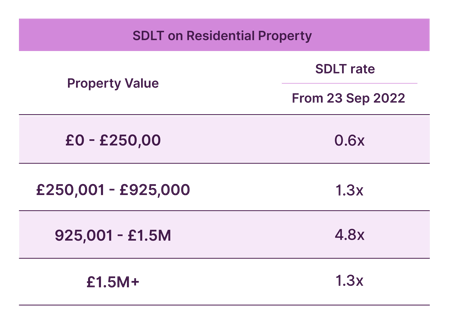

When you initially purchase a property through a limited company, you’ll be charged Stamp Duty Land Tax (SDLT). You are subject to pay SDLT if you purchase a property over a certain amount, for buy-to-lets if your property is worth more than £150,000 you are required to pay SDLT. The amount you pay depends on various factors: if you’re a first-time buyer, if you’re purchasing an additional property and whether or not you’re a UK resident. For UK residents, the SDLT based on property value is as below.

Receiving profits from your investment: Corporation Tax

Receiving profits from your investment: Corporation Tax

Purchasing a property in your own name means you are subject to Income Tax and National Insurance Contributions, when buying through a limited company you are not required to pay either of these and are only charged Corporation Tax on your rental income.

Corporation Tax is charged on the profits made by the company, after the removal of certain allowed expenses, but before dividends are paid to shareholders. If your company makes £50,000 or less in profits, you would be subject to 19%. If profits are above £250,000 it is 25%. If your profits are between the two amounts you could be entitled to ‘Marginal Relief’ on the 25% tax rate.

The lack of Income Tax and National Insurance Contributions is one of the main reasons it may be more profitable for property investors to use the limited company structure for purchasing their buy-to-lets. You can calculate your corporation tax or income tax liability with our buy-to-let income tax calculator.

Selling your property investment: Capital Gains Tax

Like most other forms of tax, Capital Gains Tax (CGT) differs depending on whether you bought the property in your own name or through a limited company. Depending on your tax bracket, you can be charged 18% or 28% CGT when you sell a property bought in your own name. If you are selling a property that you bought using a limited company, you can sell the shares of the company instead and the CGT for this is either 10 or 20%.

Another benefit of the limited structure is the reduced CGT that investors are required to pay when exiting their investments, it once again can make this structure a more favourable option for property investors.

Why a limited company is more profitable for your buy-to-let

A lot of the reasons that make limited companies more profitable than personal ownership lies in the tax advantages they present to property investors. Being able to deduct mortgage interest from your tax bill; taking income out of your property without facing income tax; and significantly lower capital gains tax are all profitable benefits of this investment structure.

How GetGround can help with your tax... and accounting

Accounting and tax can be complex, especially if you're doing it for a limited company and for multiple properties. At GetGround, we are committed to continuously making property investment easier and that’s why we’ve created an Accounting and Tax service that can help you scale. How exactly have we done this? By developing a digitalised experience on our streamlined platform where you can upload all your documents, collaborate with shareholders, access your business account and an investment Pot, and get dedicated support. Get in touch now for easy Accounting and Tax with GetGround.

For an overview of all things buy to let company and tax, explore this quick guide to get started.

This is for your information only – you shouldn't view this as legal advice, tax advice, investment advice, or any advice at all. While we've tried to make sure this information is accurate and up to date, things can change, so it shouldn't be viewed as totally comprehensive. GetGround always recommends you seek out independent advice before making any investment decisions.

Streamline your entire property investment journey

GetGround is the all-in-one property investment platform designed for high returns, with low effort. Built for every stage of the journey, you can find, finance, structure and sell your property investment. No matter if you’re an experienced landlord or a first-time investor - we’re here to help.

The GetGround Team

The GetGround Team

Discover our recent property investing articles:

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...

How Economic Factors Can Impact UK Landlords

Even with the recent volatility of the UK economic market, the UK property market has remained resilient with homeowners and property investors still ...