Robert Jones, the founder of the Property Investments UK, assists investors from the UK and worldwide in navigating the UK property market, from sourcing property opportunities to discovering new growth locations.

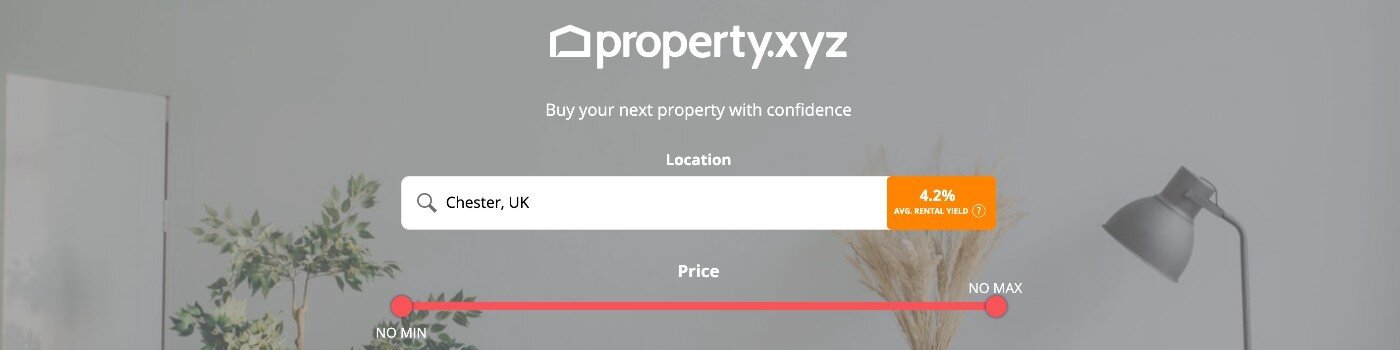

He is also the co-founder of property tech start up property.xyz. A UK based tech company, providing fast, free and comprehensive data on over 28 million properties across the UK.

With 19 years of property investing experience and unique insights into varied property strategies, Robert’s philosophy is very much one of giving back and helping other property buyers simplify their own journeys.

![]()

Tell us a bit about yourself, and the work you do at Property Investments UK and property.xyz.

I started in property in 2005 with my first professional buy to let in the North west of England. This started a journey which has included working as an estate agent and valuer, a property sourcer and developer.

For the past 12 years though my journey has very much been focused on helping and supporting other property investors get started in property and build their own portfolios.

As the founder of Property Investments UK, we help support clients on finding and purchasing properties, with 100+ property acquisitions for clients in 2023.

As the co-founder of property.xyz, my time is very much spent on product and helping all property buyers, find quick free data to support them in purchasing their next property.

And how does GetGround help you support your clients on that journey?

Many of our clients aim to purchase properties with a long term strategy, building a portfolio designed for longevity from the outset. Tax planning is a key part of that and GetGround helps support a number of our clients with the tax aspect of their planning.

Talk us through your experience partnering with GetGround – what have been some of the main benefits?

It’s important to clients to have trusted sources they can rely on. In property that means everything from letting agents to conveyancing. Taxation to planning.

Knowing we can introduce a client of ours, that is ready to purchase a property, but needs clarity and insight on the best company structure to do that, to GetGround and not need to worry about the level of service and guidance the client will receive is a comforting feeling and a great benefit to all

What do your clients say about the partnership?

They like the simplicity of the company setup and the clear pricing of the financial account management

What's next for your partnership with GetGround?

In a world of fast paced technology and slow moving real estate. We are excited to bring the gains we have made recently in the property data and technology space to our partnership with GetGround, to help all clients now and into the future finding the right data, at the right time of their buying journey.

Nikkita Papoutsis

Discover our recent property investing articles:

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...

How Economic Factors Can Impact UK Landlords

Even with the recent volatility of the UK economic market, the UK property market has remained resilient with homeowners and property investors still ...