GetGround caught up with Erskine Financial, a family run Financial Advice firm specialising in Mortgages and Financial Protection, for a quick spotlight on our ongoing partnership.

.png)

Hi, Louise – tell us a bit about yourself, and the work you do at Erskine Financial

I’m Louise McNally, born in Gloucestershire but now based in Edinburgh with two crazy daughters, aged eight and two. I’m a qualified mortgage and protection advisor within Erskine Financial, with a business development element to my role.

And how does GetGround help you support your clients on that journey?

GetGround supports our business by offering a pragmatic service solution to our limited company buy-to-let owners, both new and existing.

Talk us through your experience partnering with GetGround – what have been some of the main benefits?

We have always found GetGround to be prompt, upfront and great with clients - nothing is ever a problem and we have always been able to contact support teams easily. The main benefit has been the seamless line of communication that the team has with ourselves as advisers, and the client during the setup process.

What do your clients say about the partnership?

Clients always find the partnership smooth and uninterrupted, and love the fact we can share information between us. They like the open communication with the customer facing team and have only ever given us positive feedback on the journey they have had with GetGround.

What's next for your partnership with GG?

We are excited about working collaboratively going forward, with in-person events on the horizon!

Think your clients could use all the benefits of a limited company, without all the usual hassle? Learn more about partnering with GetGround here. Or, if you’re an existing partner looking to feature in our Partner Spotlight series, just reach out to your Partner Manager – we’d love to chat.

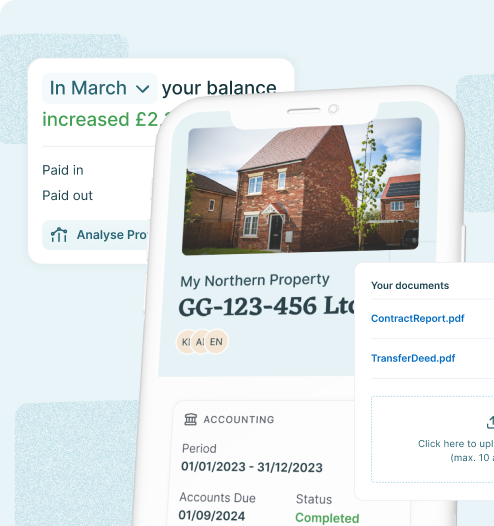

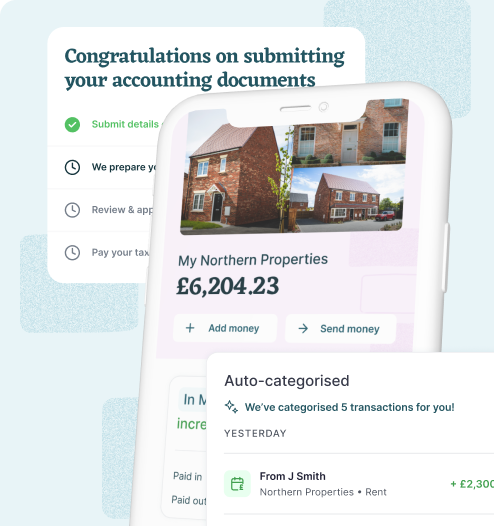

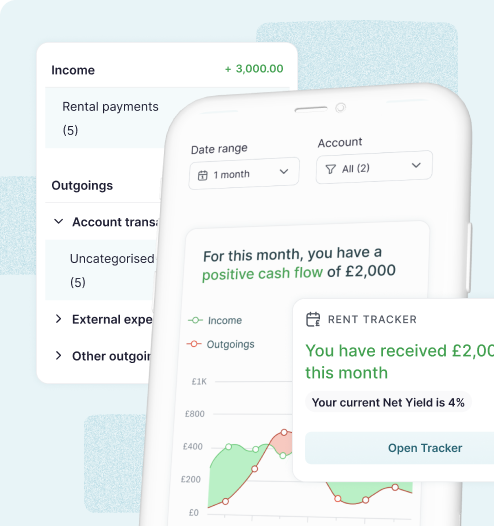

Structuring your property investment

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

The GetGround Team

The GetGround Team

Discover our recent property investing articles:

Should I transfer my personally owned property to a UK limited company?

Landlords with buy-to-lets in personal ownership may be able to transfer their property into a new limited company. However, this process involves ...

A Guide to Compliance for Landlords in the UK (2025)

Navigating compliance as a landlord in the UK requires keeping up with evolving legislation and requirements. This guide covers the latest rules ...

Was the Autumn Budget 2024 update better than expected for buy-to-let? What it means for landlords…

The 2024 UK Autumn Budget announcement brings key changes that affect property investors in different ways. Whilst some of those changes increase the ...