If you're a landlord with a limited company on the GetGround platform, you've probably heard of business accounts. Our business accounts are designed for property investments, providing landlords with a streamlined way to manage expenses and returns from their investments.

At GetGround, our aim is to make property investment easier, but smarter at the same time. We've been thinking about how to make your business accounts work harder for you and your returns for easy, high-value profits. Today, we're revealing our newest product.

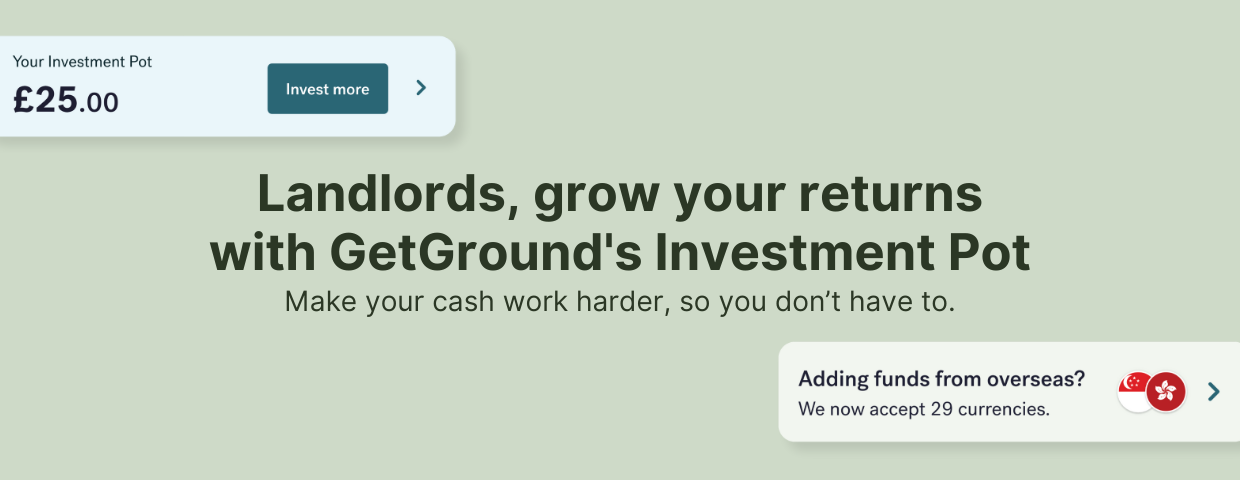

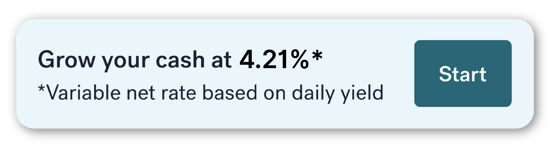

Introducing Investment Pots: a General Investment Account (GIA) that allows you to invest in a low-risk rated* Blackrock Money Market Fund invested in UK Government debt, as with all investments, your capital is at risk. All onboarded limited companies with existing business accounts have access to this feature directly on the GetGround platform itself. With this new product, protecting your company cash from inflation is available at the click of a few buttons.

Here’s how the Investment Pot works:

- Any company director can set up a Pot via the GetGround platform. Pots are free to create and all withdrawals and deposits incur no transaction fees. We charge a simple 1.5% annualised fee on the Pot balance. Learn more about Pot fees here.

- Deposit funds directly into the Investment Pot from your business account via the GetGround platform. You could do this manually, or with automated regular monthly deposits. You’ll be able to see your Pot balance and account activity easily from your dashboard. Withdrawals from your Investment Pot can be made at any time and will be placed back into your business account within a maximum of 4 working days.

- All deposits are invested into the BlackRock ICS Sterling Government Liquidity Fund (Class Premier Accumulating GBP), which is an accumulating money market fund. This means income earned is continually reinvested into the fund, to maximise returns. Learn more about the fund here.

- Sit back and watch your cash work harder every day, so you don’t have to.

If you’re ready to increase your property investment returns with no effort, get started today with your Investment Pot on your GetGround dashboard. Don't have a GetGround business account? Onboard onto our platform to get Accounting and Tax for landlords with access to a business account and our Investment Pot.

To learn more about Investment Pots, check out these resources:

*The fund is rated AAA (or equivalent) by S&P, Moody’s, and Fitch.

Capital at risk. The advertised rate of an investment is net of fees and can vary daily based on the yield of the fund. Capital at risk. The value of your investments can go up as well as down and you may receive less than your original investment.. GetGround Limited is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330). GetGround Limited is a company registered in England and Wales with company number 12476549 and registered address at 1 Lyric Square, London, England, W6 0NB. GetGround Limited can be found in the Financial Conduct Authority Financial Services register under FRN 1005044. GetGround Limited does not offer investment advice or any other advice or provide you with any recommendations regarding the suitability or appropriateness of any investments. You should make your own investment decisions and you may wish to seek advice from legal, financial, regulatory, investment, tax, accounting and/or other independent professional advisers before making an investment.

Structuring your property investment

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

The GetGround Team

The GetGround Team

Discover our recent property investing articles:

The Impact of Interest Rate Drops on UK Property Investors

On February 6th, 2025, the Bank of England announced a reduction in its base interest rate from 4.75% to 4.50%. Although an expected announcement, ...

Best Investment Property Locations in 2025: UK Regional Hotspots

The UK property market is becoming increasingly regionalised, with significant differences in growth potential, rental yields, and demand across the ...

How Economic Factors Can Impact UK Landlords

Even with the recent volatility of the UK economic market, the UK property market has remained resilient with homeowners and property investors still ...