We’re excited to announce that Habito’s range of buy-to-let mortgage products is now available to landlords via GetGround. 🎉

Habito’s rates start at 2.28% and come in at just 3.17% for a 5 year fixed at 75% LTV. Mortgage applications are open to all including self-employed, first-time, retired, and older landlords for both purchase and remortgages. Individual, limited company, and portfolio applications are also eligible.

By welcoming Habito formally onto our mortgage lender panel, we will have access to their Instant Decision engine which will give customers much more certainty at an earlier stage of the property investment journey. Habito also has no limit on portfolio size either, which means that we can work alongside them to support landlords with a larger number of properties.

We’re excited to work with Habito because of their competitively priced offering, ability to offer instant decisions (a market first!), and their fantastic jargon-free advice that will make property investing so much easier.

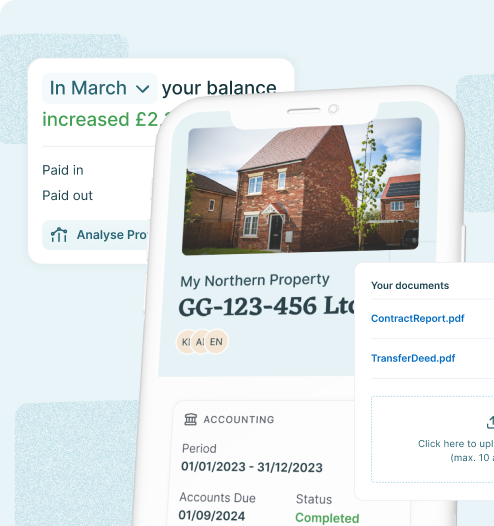

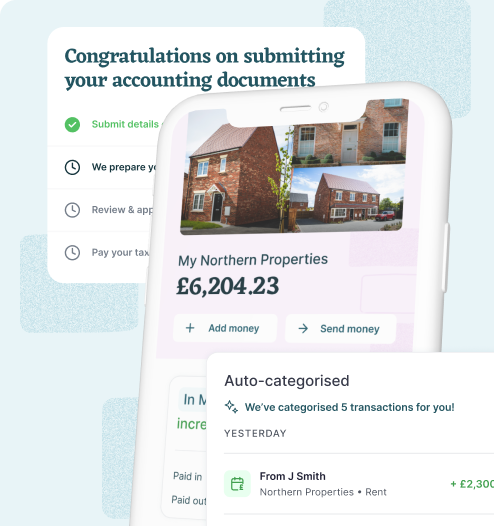

Interested in finding out more about Habito’s rates? If you’re an existing GetGround customer, you can apply directly through your dashboard. And if you don’t currently have an account with us, you can schedule a call with one of our specialists here to discuss what products we could offer.

Finance your buy-to-let property

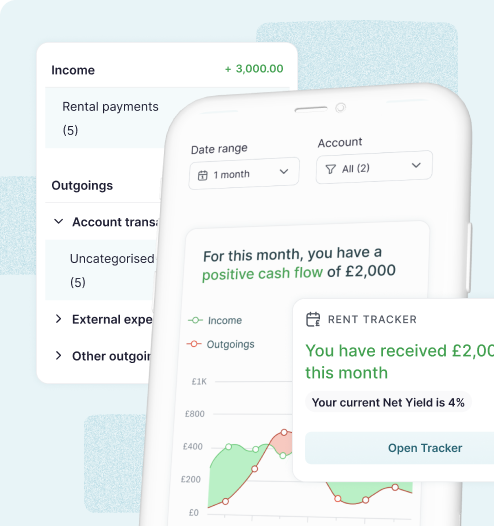

GetGround offers access to easy and competitive buy-to-let mortgages. Wherever you are in the world, we can help you finance your next property investment. GG Mortgage gives you access to a wide range of lenders in conjunction with dedicated support throughout the application process. Ready to sort financing for your buy-to-let?

The GetGround Team

The GetGround Team

Discover our recent property investing articles:

Should I transfer my personally owned property to a UK limited company?

Landlords with buy-to-lets in personal ownership may be able to transfer their property into a new limited company. However, this process involves ...

A Guide to Compliance for Landlords in the UK (2025)

Navigating compliance as a landlord in the UK requires keeping up with evolving legislation and requirements. This guide covers the latest rules ...

Was the Autumn Budget 2024 update better than expected for buy-to-let? What it means for landlords…

The 2024 UK Autumn Budget announcement brings key changes that affect property investors in different ways. Whilst some of those changes increase the ...