GetGround and Molo strike partnership to take pain and admin out of the Buy-To-Let purchase experience

GetGround and Molo, have announced today a distinctive new partnership that executes all the essential administration underpinning Buy-To-Let (BTL) purchases in one fast and comprehensive service.

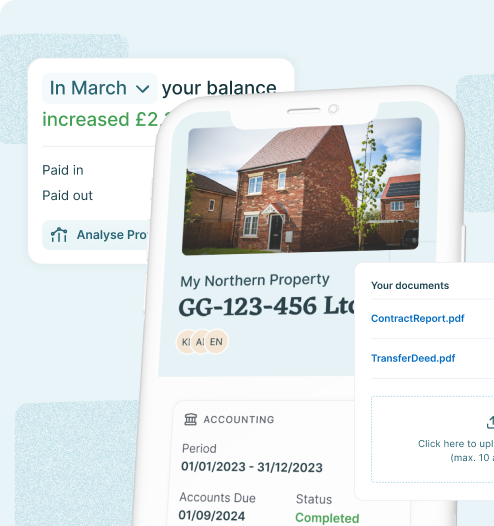

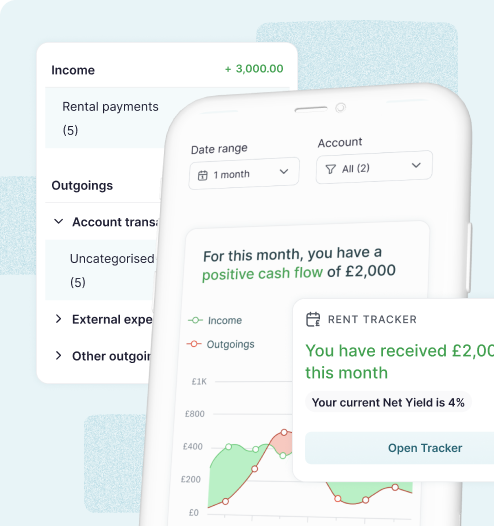

GetGround is the only digital one-stop-shop for company formation, management and current accounts in the UK BTL market. Molo is the first fully digital, direct to consumer, BTL mortgage lender in the UK.

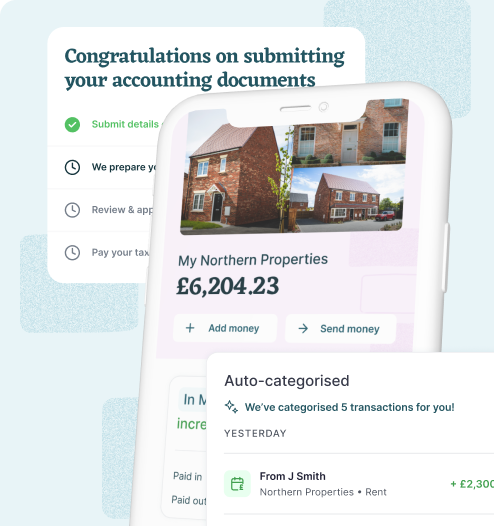

In a market first, UK BTL investors and landlords will be able to form a company, open a current account and secure mortgage finance in three fast and interconnected steps, all within the same single process. Under the terms of the partnership, the companies will integrate their platforms, providing customers with a unique opportunity to complete their BTL purchases in the most seamless, quick and simple way.

Moubin Faizullah Khan, Co-Founder & CEO at GetGround, commented: “This partnership creates one comprehensive service that never before existed. It’s an innovation that significantly reduces the cost, time and admin-induced headaches that these requirements all too often create for our customers when handled in isolation.”

Francesca Carlesi, Co-Founder & CEO at Molo, added: “Through this partnership, customers can easily set up a limited company and realise their buy-to-let ambitions with a fast and easy-to-use service. Whether it’s with GetGround or Molo, they’ll receive the same unique experience and the same combination of benefits.”

The partnership - the first of its kind in the mortgage and property investment markets - is specifically designed to benefit both GetGround and Molo customers:

- GetGround customers who are seeking BTL mortgages to fund their investment purchases can look forward to a smooth, fast transition from GetGround to Molo to make instant applications for finance

- Molo customers who choose to purchase their investment properties through companies will be able to switch over seamlessly to GetGround to do so, before returning to Molo in one click to continue their mortgage application.

Faizullah Khan added: “Our tech savvy customers come to GetGround because they value how quickly and efficiently we can help them form and manage their investment companies. It’s no wonder that they want and expect the same high level of service from their mortgage lender. We’re delighted therefore that our first lender relationship has been forged with Molo. Molo’s digital approach is fast setting the standard for mortgage lending in the sector.”

Carlesi concluded: “An increasing number of our customers want to buy their properties through companies instead of personal ownership. But there was previously a gap in the market for platforms that helped them do so with the sort of pace, flexibility and competency that’s needed. Therefore, we welcome this solution with GetGround and look forward to helping more of our own customers benefit from this important partnership.”

GetGround and Molo’s partnership has been tested during a short beta phase. Giulia, an UK BTL investor, was one of the partners’ first customers to experience what the partnership could offer. She commented: “The combination of GetGround and Molo working so smoothly together has taken a lot of the stress and time out of the property buying process. The two companies are helpful and supportive to their customers; but most importantly they're talking to one another and that's what creates such a seamless, straightforward user experience.”

Structuring your property investment

GetGround can make achieving tax-efficient investing much simpler by setting up your property limited company. GG Company means you can design a limited company in under half an hour and we handle all the admin that comes with it — giving you a hassle-free way to increase the returns on your investment, reduce your personal risk, and co-invest easily with family and friends.

GetGround

GetGround

Discover our recent property investing articles:

Was the Autumn Budget 2024 update better than expected for buy-to-let? What it means for landlords…

The 2024 UK Autumn Budget announcement brings key changes that affect property investors in different ways. Whilst some of those changes increase the ...

When will my buy-to-let property return a profit?

While property investments can offer solid returns, the timeline to profitability varies widely based on several key factors. In this post, we’ll ...

What is the income tax on my property investment?

One of the most significant taxes you'll encounter is income tax on your rental earnings. In this guide, we’ll break down what income tax is, how ...