If you’ve bought or sold a property, chances are you have dealt with a conveyancer at some point. Conveyancing is the legal transfer of property from the current owner to a new owner. Conveyancing solicitors act on behalf of both the buyer and the lender.

Conveyancing solicitors will:

- Organise searches for the property and check the house titles

- Check the mortgage offer and deal with exceptional conditions

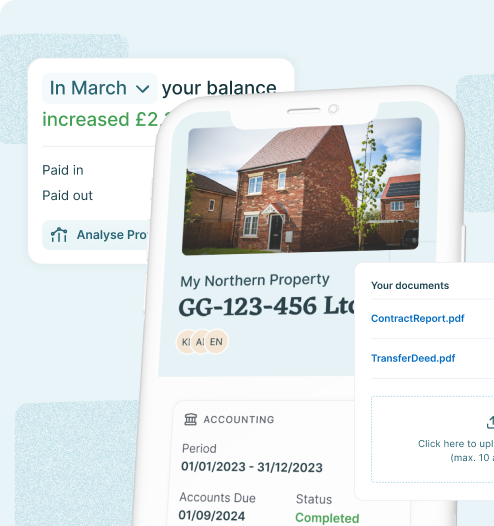

- Provide essential information and documents

- Arrange dates for exchange of contracts and completion

- Submit tax returns and transfer funds for the stamp duty and other essential tasks.

Not all buyers may want to purchase properties in their capacity as a natural person and may prefer to buy a property via a limited company.

What Further Documents are Required During the Conveyancing Process When Buying Through a Limited Company?

The conveyancer will need to make checks on the limited company to ascertain whether or not it is legally entitled to hold property, including:

- Proof of identity for the company director(s);

- Company Articles and Powers, including the company’s Memorandum and Articles of Association;

- A company search to ensure there are no issues such as pre-existing charges which may affect the lender’s decision;

- Annual returns,

- Proof of independent legal advice, as required by many lenders. This is to ensure that company directors understand the legal implication of guaranteeing mortgages.

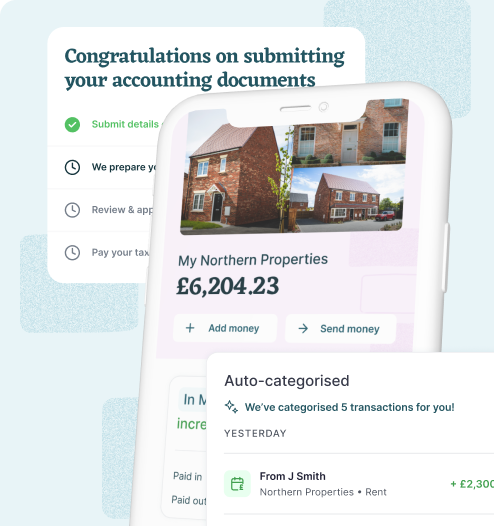

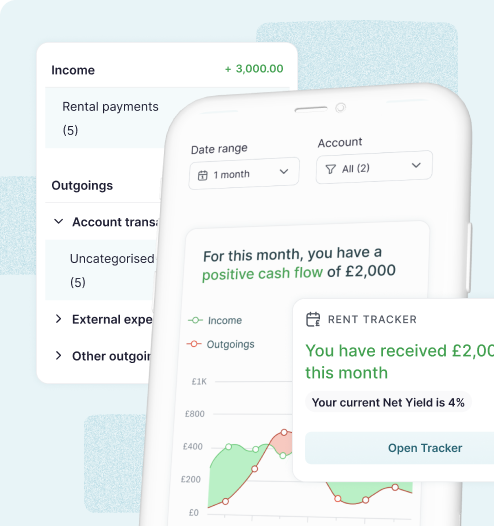

Streamline your entire property investment journey

GetGround is the all-in-one property investment platform designed for high returns, with low effort. Built for every stage of the journey, you can find, finance, structure and sell your property investment. No matter if you’re an experienced landlord or a first-time investor - we’re here to help.

GetGround

GetGround

Discover our recent property investing articles:

Should I transfer my personally owned property to a UK limited company?

Landlords with buy-to-lets in personal ownership may be able to transfer their property into a new limited company. However, this process involves ...

A Guide to Compliance for Landlords in the UK (2025)

Navigating compliance as a landlord in the UK requires keeping up with evolving legislation and requirements. This guide covers the latest rules ...

Was the Autumn Budget 2024 update better than expected for buy-to-let? What it means for landlords…

The 2024 UK Autumn Budget announcement brings key changes that affect property investors in different ways. Whilst some of those changes increase the ...