Stand 215 – the home of better buy-to-let

It’s that time of year again. A time to listen, learn, and load up on free pens look out for that next investment. That’s right – the Property Investor Show is almost upon us. And, as always, we’ll be there on both days to talk all things buy-to-let.

If you’re attending too, we’d love to see you – wherever you are in your investment journey. Here’s five reasons to stop by Stand 215:

1. Discover blissful buy-to-let

89% of investors wish the buying process was faster, and 78% loathe the experience entirely. That’s why we’ve launched GetGround packages – bringing together everything you need to invest quickly, all under one roof, and providing expert support from search, to purchase, to finding your first tenant.

Wander over to Stand 215, and learn a bit about how you can inject your buy-to-let experience with a bit of bliss.

2. Master a moving market

The market’s quite tricky at the moment (you might’ve noticed). Mortgage costs are rising, tax cuts left and right – plenty’s changing. But change means opportunity, if you know where to look.

That’s why we’ll be diving deep into the state of the market with a free, all-encompassing seminar. Running on both days, and led by two of our UK property experts, we’ll explore:

- The nature of those market movements

- What they mean for investors, both existing and aspiring

- Regions ripe for profitable investment

Drop by the seminar at 11.45am on Friday, or 4.05 on Saturday, and learn how to profit amid the madness.

3. Find your next new investment

Looking for your next property (or perhaps your first)? Discover hundreds of high-yield listings from across the UK with GetProperty, our curated property portal.

Chat with our industry experts about your budget and unique goals, and they’ll be on-hand to help you find that perfect place. If you’ve got five minutes, they’ll also walk you through our nine-stage vetting process, and the bespoke property analysis every GetProperty customer receives.

93% of investors struggle to find that ideal buy-to-let investment – you needn’t be one of them.

4. Tame your tax bill

The number of buy-to-let investors buying through a limited company has doubled since 2017 – largely (though not exclusively) because of the tax benefits. In our second seminar of the Property Investor Show, we’ll be exploring all the reasons a limited company approach may make sense for you and your investment.

We’ll also dispel a couple of myths you might’ve heard about this approach – so you can make the decision with all the facts, and none of the fluff.

Join us for our limited company investing seminar at 4.10pm on Friday.

5. Switch to laid-back landlording

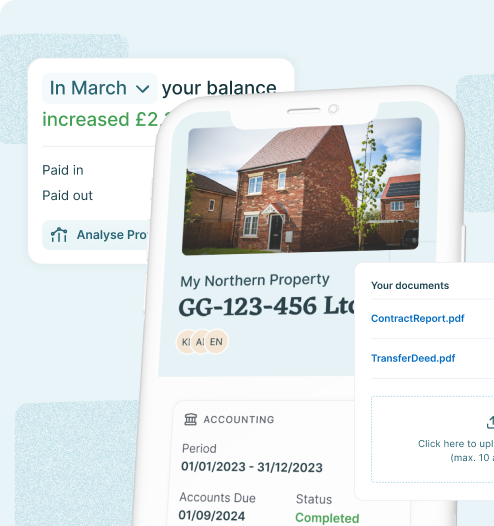

While the limited company route comes with significant tax-saving opportunities, it can also lead to a fair bit of hassle – accounting, legal documents, secretarial work…

But, at the Show, we’re excited to unveil our Switch Service – helping anyone who’s just set up a company to enjoy all the tax benefits, with none of the time-sucking directorial duties you’d usually expect.

Switch to a GetGround company, and we’ll handle everything – from tax returns, to purpose-built legal documents and all your filing – for just £0.63 per day. Pop into Stand 215 to get your switch started.

Register for free here. See you there!

We’re looking forward to chatting with as many investors as possible over the course of the show. Of course, if you’d like to discuss your goals beforehand, you can arrange a call with an industry expert at a time that suits you.

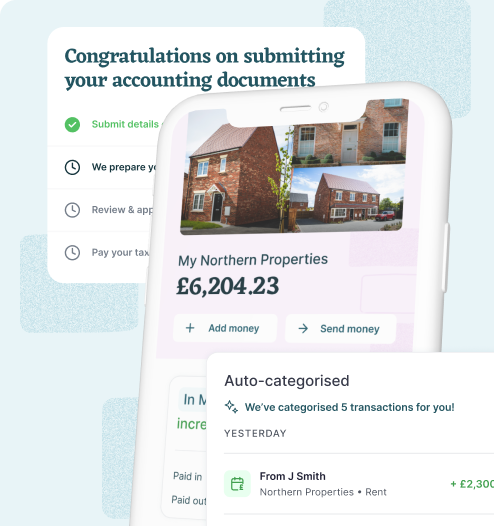

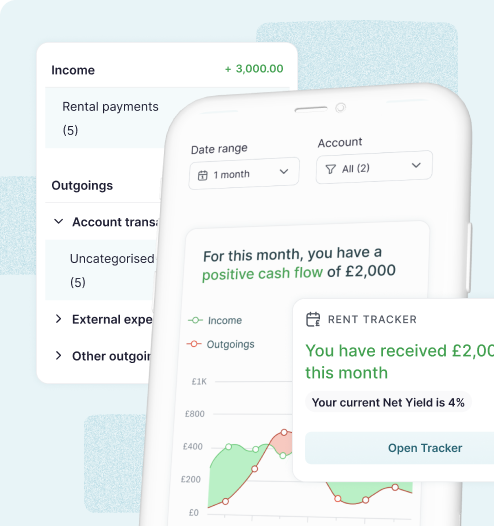

Streamline your entire property investment journey

GetGround is the all-in-one property investment platform designed for high returns, with low effort. Built for every stage of the journey, you can find, finance, structure and sell your property investment. No matter if you’re an experienced landlord or a first-time investor - we’re here to help.

GetGround

GetGround

Discover our recent property investing articles:

Should I transfer my personally owned property to a UK limited company?

Landlords with buy-to-lets in personal ownership may be able to transfer their property into a new limited company. However, this process involves ...

A Guide to Compliance for Landlords in the UK (2025)

Navigating compliance as a landlord in the UK requires keeping up with evolving legislation and requirements. This guide covers the latest rules ...

Was the Autumn Budget 2024 update better than expected for buy-to-let? What it means for landlords…

The 2024 UK Autumn Budget announcement brings key changes that affect property investors in different ways. Whilst some of those changes increase the ...